FCC improves Ebitda by 9.3% in the first half of 2019

- In the first half of 2018, turnover amounted to 2,993.8 million euros, 5.5% more than in the same period of the previous year.

- The revenue portfolio at the end of the first half of the year increased to 30,690.8 million euros, representing an increase of 5.9% compared to the end of the same period of the previous year

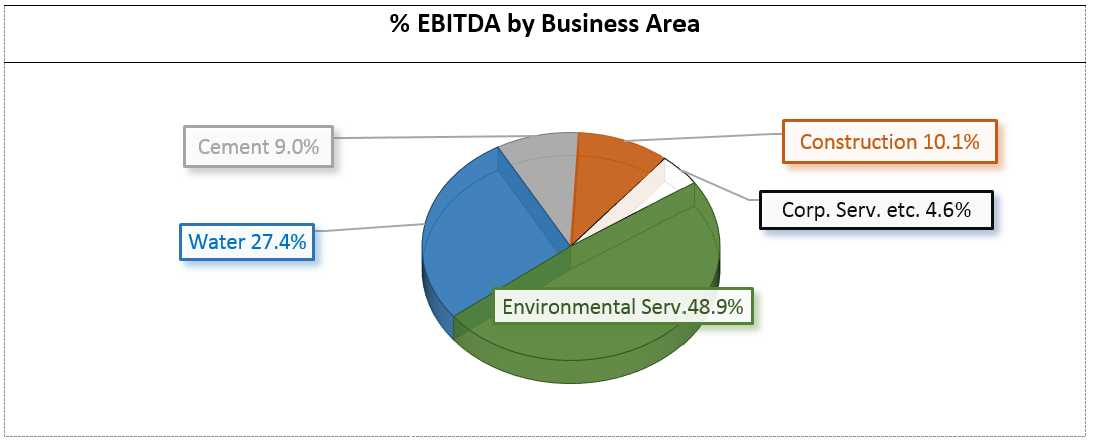

FCC Group's gross operating profit (EBITDA amounted to 461.3 million euro in the first half of the year, representing an increase of 9.3% compared to the previous year. This result is supported by the increase recorded in the revenue from all the Group's business areas. The operating margin increased to 15.4%, thanks to the greater contribution from the business areas, in particular, Environment and Water, that together accounted for 76.3% of the consolidated Ebitda in the period.

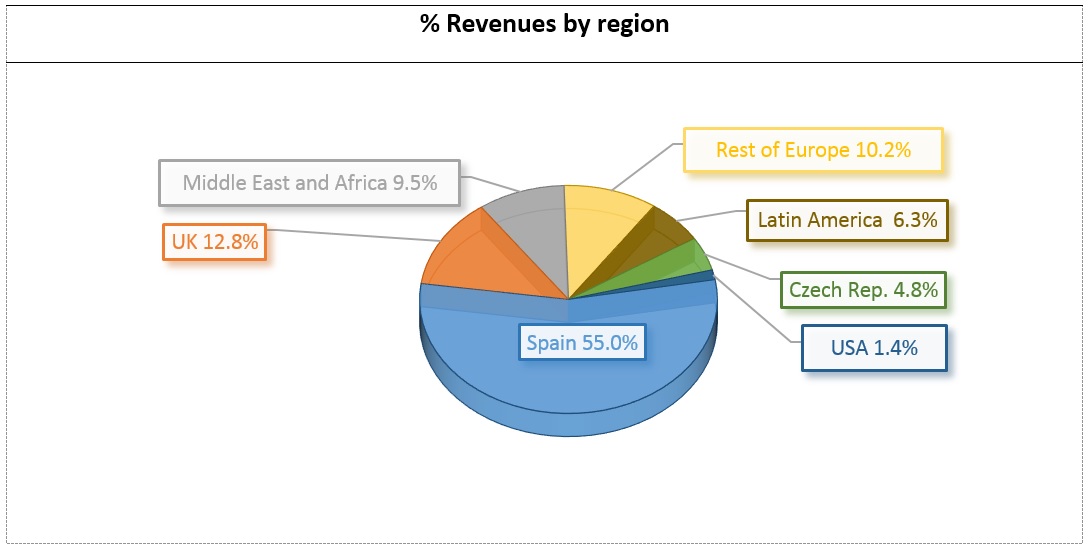

In the first half of 2018, turnover amounted to 2,993.8 million euros, 5.5% more than in the same period of the previous year. This increase was recorded in all business areas, due to the development of new projects and higher demand volumes in Spain, particularly in Cement and Water business areas (13% and 7.7%, respectively; Environment with a performance of 5.2%; and Construction with a 4% increase.

The revenue portfolio at the end of the first half of the year increased to 30,690.8 million euros, representing an increase of 5.9% compared to the end of the same period last year. This result is particularly noteworthy in the Construction business area's revenue portfolio, which grew by 11.3% at the end of this period, reaching 5,024.8 million euros, where Spain experienced a significant growth of 67.9% due to new contracts such as the remodeling of the Real Madrid football stadium or the construction project of the Mediterranean high-speed motorway Murcia-Almería.

The attributable net profit in the first half of the year was 128.9 million euros, which represents a reduction of 15% compared to the 151.7 million euros obtained in the same period in 2018, primarily due to the increase of 27.8 million euros corresponding to minority shareholders, mainly based in the Water business area.

Consolidated net financial debt at the end of the first half of the year amounted to 2,972.2 million euros, which represents an increase of 280.8 million euros compared to December 2018, due to working capital increase and ongoing growth investments, but with a very significant year-on-year reduction of 866.4 million euros.

Significant events

FCC Environment presents 'Zero Waste' masterplan in the United Kingdom

FCC Environment, the company that heads the environment business in the UK, has presented a new masterplan linked to its Greengairs landfill in direct response to the Scottish Government's 'Zero Waste' strategy. Under the strategy, the disposal of biodegradable waste in landfills will be prohibited from 1 January 2021, creating a significant shortage of treatment facilities. The construction of the Drumgray complex will cost approximately €400 million and will include an energy-from-waste plant for biodegradable waste that would otherwise be disposed of in the landfill. The facility will be able to process up to 300,000 tons of waste per year, and its 25.5 MW electricity generator will supply power and heat to local homes and businesses.

Aqualia enters France and expands its footprint in the UAE with two new contracts worth €100 million

In June, FCC Aqualia acquired Services Publics et Industries Environnement (SPIE), a French end-to-end water management company. Additionally, in Spain it acquired Agua y Gestión and a stake in Codeur. These acquisitions amounted to a total of €38 million.

This area also obtained a €40 million contract for operation and maintenance (O&M) of the wastewater system in the city of Abu Dhabi and in the adjacent islands of Al Reem, Al Maryah and Al Saadiyat. Additionally, the client administration has renewed the sanitation contract for the city of Al Ain, in the east of the Emirates, for seven years, representing more than €60 million in revenues.

As a result, Aqualia's contracts in the Arabian Peninsula (Saudi Arabia, UAE, Qatar and Oman) amount to over €600 million. The projects, which are mostly medium- and long-term concessions, reflect the growing success and acceptance of the public-private partnership (P3) model for developing and operating essential infrastructure in the region, where the company serves a total of 6 million people.

FCC Environment advancing with the development of its new EfW plant in the United Kingdom

In the first quarter, FCC Environment signed a deal to develop and operate a new energy-from-waste plant in Lostock, in partnership with Copenhagen Infrastructure Partners (CIP) fund, owning 60% and 40%, respectively. The project represents a total investment of £480 million. Once operational, it will one of the largest energy-from-waste facilities in Europe, with an initial capacity to process 600,000 tons per year.

Also in the United Kingdom, the company obtained a contract worth over £26 million to operate 11 recycling centres in Suffolk. It already operates close to 100 household recycling centres in the UK, recycling and recovering 1.6 million tons of waste each year.

Stronger position in the US, supported by Environmental Services

Palm Beach Country (Florida) has awarded FCC Environmental Services, the parent company of the Environment division in the United States, a municipal solid waste collection contract worth $215 million which runs for 7 years from 1 October 2019. FCC will deliver the service using a fleet of 108 vehicles, including 90 garbage trucks and a range of light vehicles.

This fourth contract in Florida, alongside the existing contracts in Orlando (Orange County) and Lakeland (Polk County), enhances FCC's position in the US. FCC's backlog in municipal services in the US, which also includes ten contracts in Texas, amounts to $1,100 million, and it serves a total population of 8 million.

FCC distributes €0.4/share flexible dividend. Over 99% of the shareholders chose shares.

At FCC's Shareholders' Meeting on 8 May, the shareholders approved all the items on the agenda, including a flexible (scrip) dividend. As a result, FCC paid €0.4 per share to the shareholders who opted for cash, and the equivalent amount in shares to the remainder. Over 99% of the shareholders opted for shares. This is the first time that the FCC Group has used a flexible dividend formula of this type.

KEY FIGURES

| (M€) | Jun. 19 | Jun. 18 | Chg. (%) |

| Net sales | 2,993.8 | 2,838.1 | 5.5% |

| EBITDA | 461.3 | 422.1 | 9.3% |

| Ebitda margin | 15.4% | 14.9% | 0.5 p.p |

| EBIT | 244.8 | 237.7 | 3.0% |

| Ebit margin | 8.2% | 8.4% | -0.2 p.p |

| Income attributable to equity holders of the parent company | 128.9 | 151.7 | -15.0% |

| (M€) | Jun. 19 | Dec. 18 | Chg. (%) |

| Equity | 2,124.8 | 1,958.8 | 8.5% |

| NET FINANCIAL DEBT | 2,972.2 | 2,691.4 | 10.4% |

| BACKLOG | 30,690.8 | 28,990.8 | 5.9% |